With the end of the year fast approaching, now is the ideal time to make smart investments for your business by adding to or upgrading your truck fleet. Thanks to the Section 179 tax deduction, you can significantly reduce your tax liability on any qualifying purchases of new or used trucks and trailers that are put into service by December 31, 2025.

What is the Section 179 Deduction?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment bought, leased or financed during the tax year — enabling you to write off the cost of new or used equipment in the same year it’s placed in service.

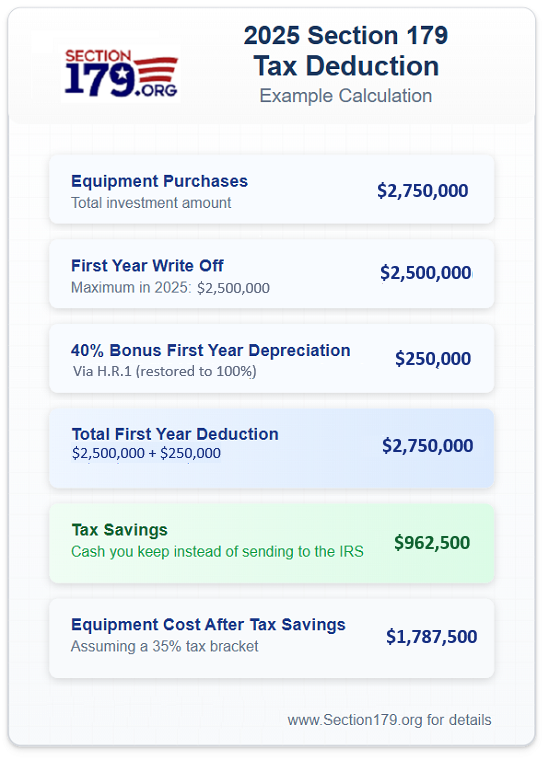

For the 2025 tax year, eligible business owners can deduct up to $2,500,000 in qualifying purchases. The deduction begins to phase out dollar-for-dollar once total qualifying equipment purchases exceed $4,000,000, and it is fully phased out at $6,500,000.

In addition to Section 179, businesses can take advantage of 100% bonus depreciation for remaining eligible costs of new or used equipment after applying the Section 179 deduction.

Want to see your potential savings? Use our deduction calculator below to estimate tax benefits based on your planned purchases. (Always consult your tax advisor for your specific situation.)

The ideal time to upgrade your fleet

Whether you’re looking for light, medium, duty, or severe-duty trucks, Pliler International can outfit your fleet with the very latest trucks that qualify for Section 179 and suit your exact needs. Make the smart purchase for your business now whether it’s one or several new trucks. Talk to one of our sales team members today about options we have available.

Before making any large purchases, we recommend discussing Section 179 details with your tax advisor to confirm eligibility and optimize your tax strategy. They can guide you through the specifics and help you get the most out of this valuable deduction.

use section 179 deduction on used trucks

Not necessarily looking for or needing a “new” truck? It’s still the perfect time to take advantage of the Section 179 deduction on one or more used trucks. Check out our full inventory of used trucks here online and don’t miss this chance to take full advantage of Section 179 before the year ends!